The moment you start building a professional life in the U.S., your credit score becomes one of your most valuable, and sometimes most confusing, assets. For us, young Latinos navigating the American financial system, understanding this three-digit number isn’t just about getting a loan, it’s about laying a solid foundation for our future, our family, and our piece of the American Dream.

Let’s be honest, for many of us, this wasn’t a topic covered around the dinner table. This guide is here to change that. We’ll break down exactly what your credit score is, why it matters so much for our community, and how we can take control of it.

Why Credit is Different for the Latino Community

It’s important to acknowledge that the path to financial health can look different for us. Many Latinos may come from families or cultures where using credit cards or taking on debt was not common, or they may be the first in their family to navigate these waters in the U.S.

The data shows why building strong credit is so critical for us:

- A Financial Gap Exists: While we are a huge engine of economic growth, disparities persist. For example, a significant percentage of Latinos are unbanked or underbanked compared to the general population, which can make establishing a credit history more challenging (according to the Federal Deposit Insurance Corporation (FDIC)).

- Financial Stress is Real: The need to build a financial safety net is pressing. Currently, a majority of Latinos (58%) say their personal financial situation is in “only fair” or “poor” shape, highlighting the urgency of mastering tools like credit (according to the Pew Research Center).

- The Power of a Score: A good credit score can save us thousands of dollars over a lifetime. This is especially true as we pursue major milestones like buying our first car, getting a mortgage, or securing a business loan, all things that help build generational wealth.

Your Score: What It Is and How It’s Calculated

A credit score is a three-digit number, typically between 300 and 850, that acts as your financial report card for lenders. It tells them how reliable you are at paying back borrowed money. The two main scoring models are FICO and VantageScore.

To build or maintain a great score, we need to understand the five key components that determine it. While the exact weighting can vary, this is generally how it breaks down:

- Payment History (The Biggest Factor): Are you paying your bills on time, every time? This includes credit cards, loans, and even mortgages. Missing a payment is one of the quickest ways to damage your score.

- Credit Utilization (How Much You Owe): This is the ratio of how much credit you are using versus your total available credit. The golden rule here is to keep this ratio below 30%, and ideally below 10%. For example, if your total credit limit across all cards is $10,000, try not to carry a balance over $3,000.

- Length of Credit History (Time Matters): Lenders want to see a long history of responsible credit use. The longer your oldest account has been open, the better.

- Credit Mix (The Right Blend): Having a mix of different types of credit, like revolving credit (credit cards) and installment loans (auto or student loans), shows you can manage different financial responsibilities.

- New Credit (Limit Your Applications): Opening too many new accounts in a short period signals higher risk to lenders. Every “hard inquiry” from a loan application can temporarily dip your score.

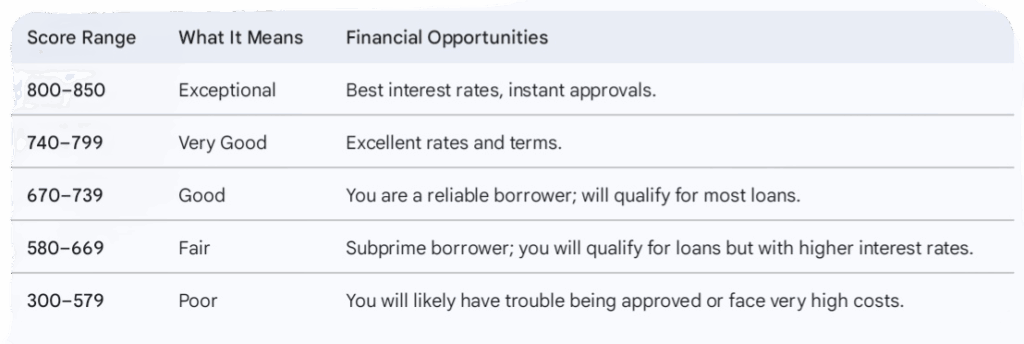

Understanding the Credit Score Ranges (What Your Number Means)

Different lenders and scoring models have slightly different labels, but this is the general framework we can use to gauge where we stand:

3 Essential Steps to Improve and Maintain Our Score

We have the power to influence our score every single month. Being proactive is the game-changer.

1. Pay on Time, Every Time. Set Up Auto-Pay.

This is non-negotiable. Missing a single payment can drop your score by dozens of points and stay on your report for up to seven years. If you have to choose, prioritize paying the minimum on all accounts over paying one account in full.

2. Be Strategic with Credit Card Balances (Keep Utilization Low)

We can’t stress this enough. If you carry a balance month-to-month, try to pay it down significantly before your statement closing date. Remember that 30% is the ceiling; the closer to 0% you can get, the better your score will look. This simple action often yields the fastest improvement.

3. Check and Protect Your Credit Report

By law, you are entitled to a free copy of your credit report from each of the three major bureaus (Experian, Equifax, and TransUnion) every 12 months at AnnualCreditReport.com. We must do this! This check is crucial to:

- Identify and dispute errors or inaccuracies (a common issue that holds scores down).

- Spot signs of identity theft or fraudulent accounts.

Don’t Fall for the Myths: Credit Score Misconceptions

There is a lot of bad advice out there, especially when we’re just starting. Let’s set the record straight:

- Myth: Closing an old credit card is good because you have less credit to manage.

- Reality: Closing an old card actually hurts your score by reducing your total available credit and shortening your length of credit history. Keep the old accounts open, even if you just use them once or twice a year for a small purchase and pay it off immediately.

- Myth: Checking your own credit score lowers it.

- Reality: Checking your own score is a “soft inquiry” and has absolutely zero impact. Only applying for new lines of credit (a “hard inquiry”) has a temporary effect. Check your score often!

- Myth: Your income directly affects your credit score.

- Reality: Your income is not a factor in your score calculation. The score is solely based on your history of borrowing and repaying debt.

Summary: Taking Control of Our Financial Story

For young Latinos in the U.S., a great credit score isn’t a luxury: it’s a powerful tool for upward mobility. It gives us leverage, saves us money, and opens the door to financial opportunity. By making timely payments, keeping our utilization low, and regularly checking our reports, we are actively writing a solid financial chapter for our lives.

👉 Ask Gabi anything, anytime.

Stay tuned! We got you!