Community, Financial Education,

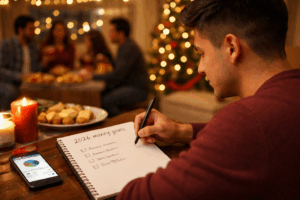

Financial “Spring Cleaning” in January: Auditing Your Habits for a Prosperous 2026

¡Feliz Año Nuevo, familia! The holiday lights are coming down, the last of the tamales have been cleared from the fridge, and the energy of the new year is...