Welcome back, hermanos! Starting your professional life in the U.S. is an incredible milestone, but for many of us, it comes with the weight of student loan debt. As young Latinos, we are pursuing higher education at significant rates: about 55.4% of Hispanic or Latino high school graduates immediately enroll in college, showing our community’s commitment to building a better future (Bureau of Labor Statistics data, cited by Admissionsly).

But that commitment often comes with a financial cost. That’s why understanding the difference between federal, private student loans, and especially the repayment options for federal loans is critical to protecting our hard-earned progress.

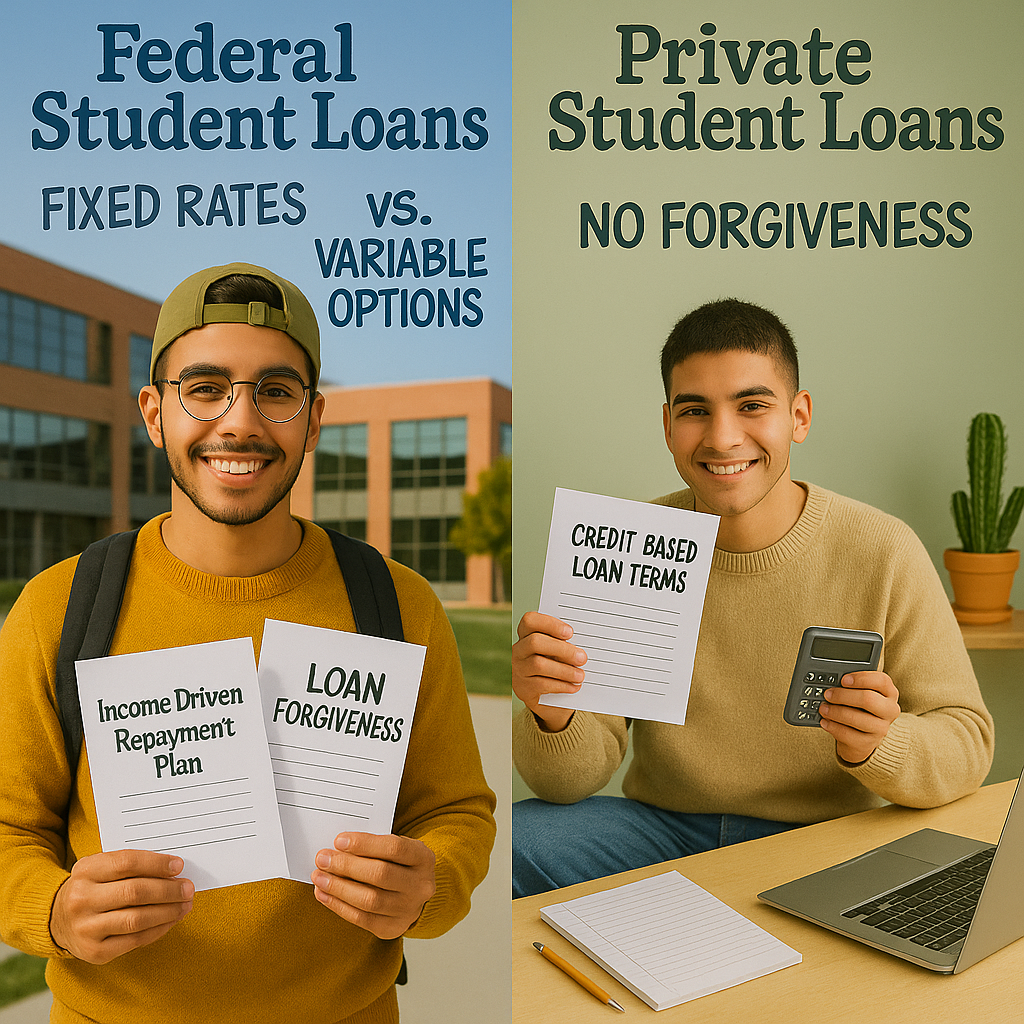

Federal vs. Private Student Loans: The Difference is Protection

When you first took out loans, you likely encountered two main categories: federal and private. While both provided funds for your education, their rules for repayment, interest, and most importantly, borrower protection are vastly different.

| Feature | Federal Student Loans | Private Student Loans |

| Interest Rates | Fixed, set by the government (often lower). | Can be fixed or variable; set by the lender based on your credit score. |

| Repayment Flexibility | High. Offers Income-Driven Repayment (IDR) plans. | Low. Typically requires a fixed monthly payment. |

| Borrower Protections | Strong. Includes deferment, forbearance, and loan forgiveness programs. | Weak. Generally lacks loan forgiveness and has stricter terms. |

| Credit Check | Generally not required for most undergrad loans. | Required. Approval and rate depend on your credit history. |

The Power of Federal Loans: Income-Driven Repayment (IDR)

These plans are essential because they recognize that your initial income may not support a standard loan payment. IDR plans calculate your monthly payment based on your income and family size.

How IDR Plans Help Our Community:

- Financial Breathing Room: Lowering your monthly payment when you’re starting out frees up cash for other critical financial steps, like building an emergency fund or saving for a down payment.

- Protection Against Financial Hardship: If your income dips or your expenses rise, IDR plans can adjust your payment, preventing you from defaulting on your loan.

- The Path to Forgiveness: After a set period of time (typically 20 or 25 years, or less for Public Service Loan Forgiveness), any remaining loan balance is forgiven under most IDR plans.

A Note on Debt: While college is a strong investment, student debt disproportionately affects our community. A 2016 study found that 48% of Latino student borrowers feared they would struggle to pay off their student loans, compared to 36% of white borrowers (Demos, “Latinos, Student Debt, and Financial Security”). Understanding IDR options is one of the most powerful tools we have to manage this burden.

Beyond Repayment: Forgiveness and Forbearance

Federal loans provide a financial safety net that private loans generally do not:

- Loan Forgiveness: Programs like Public Service Loan Forgiveness (PSLF) can eliminate your remaining balance if you work full-time for a qualifying non-profit or government employer for 10 years while making qualifying payments.

- Deferment and Forbearance: These options allow you to temporarily postpone or reduce your payments during times of financial difficulty, such as job loss, military service, or returning to school. Interest may still accrue during these periods, but having the option is vital for staying afloat.

Making the Smart Choice for Your Future

The bottom line is that federal student loans almost always offer better protection and more flexible repayment plans. Private loans may be necessary to cover gaps in funding, as they often have higher limits, but they should generally be considered after you have maximized your federal aid options.

When managing your loans, focus on:

- Knowing Your Loans: Identify whether you have federal or private loans, and which repayment plan you are currently on.

- Exploring IDR: If your federal payments are a strain, research the various IDR plans to see which offers the lowest monthly payment and the best long-term outcome for your financial goals.

- Using Resources: Utilize online tools to estimate what your monthly payments would look like under different IDR plans.

By taking an active role in understanding these options, we are turning a financial obligation into a manageable part of our journey toward wealth and stability.

👉 Ask Gabi anything, anytime.

Stay tuned! We got you!