Welcome back, hermanos!

Thanksgiving is more than just a Thursday in November; it’s the official starting line of the holiday season, a time for reunión, reflection, and, let’s be honest, spending. For the young Latino professional in the U.S., Thanksgiving can feel like a high-stakes challenge: how do you honor the tradition of fartura without overextending your budget?

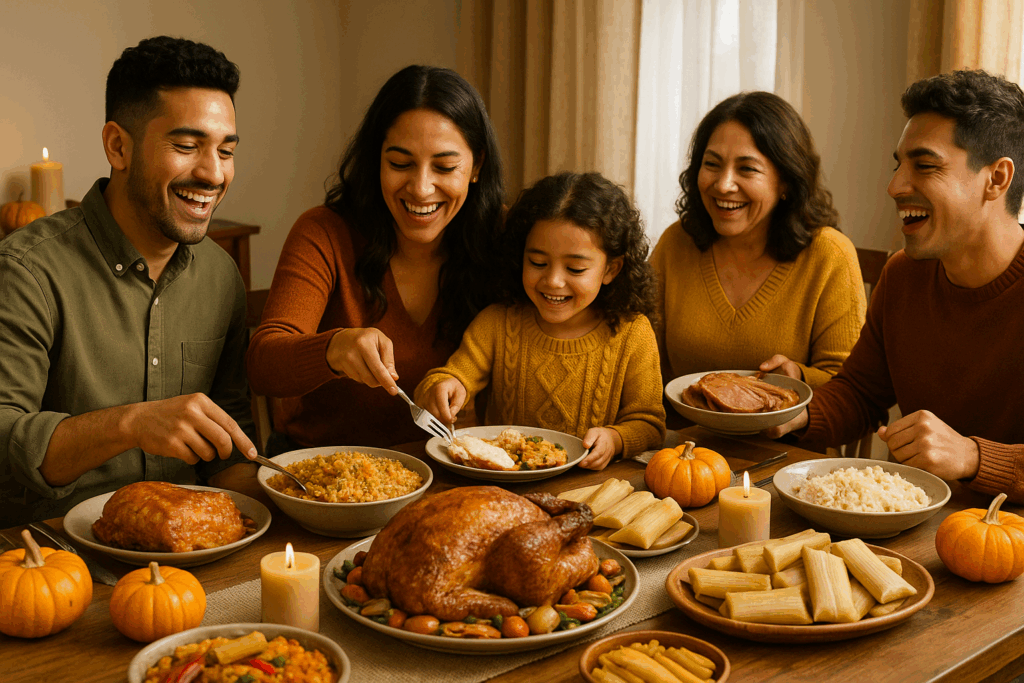

For our community, family means big gatherings, and big gatherings mean big tables with more than just a turkey. We’re talking pernil, arroz con gandules, tamales, and a dozen tías and tíos ready to celebrate. But all that love comes with a price tag.

As we navigate this season, it’s important to remember that our community’s financial impact is massive, yet we often face unique financial pressures. Data shows that U.S. Latinos plan to spend an average of $2,218 on holiday expenses (BMO Survey), which is significantly more than the national average. While that commitment to loved ones is powerful, it also means that over 55% of us plan to use debt, including credit cards, to cover these costs.

This Thanksgiving, let’s empower ourselves by bringing that family-first mindset to our personal finances. We can feast like reyes without starting the new year with unwanted debt.

Here are five essential tips to ensure your cena is rich in culture and financially smart.

1. The Feast Forecast: Budget Your Pernil vs. Your Turkey

The classic American Thanksgiving dinner for 10 people currently averages around $58.08 (Farm Flavor) and while prices have dropped slightly from recent highs, they are still nearly 20% higher than pre-pandemic costs (AFBF). When you add in the rich side dishes from your family’s country of origin, that cost can easily double.

The first step in financial control is creating a “Feast Forecast” budget before you step into the grocery store.

- Set a Hard Limit: Decide on the total dollar amount you will spend on food, drinks, and decor. Is it $100? $200? Be firm with your límite.

- Cost-Benefit Analysis: Main Dish: Are you serving a 16-pound turkey (which costs around $25-$30) (AFBF) or a whole pernil? Price them both out early and commit to the most budget-friendly option that still honors your tradition.

- The 50/30/20 Rule for the Table: Allocate your budget: 50% for the main dishes (protein/carbs), 30% for sides and dessert, and 20% for drinks and incidentals.

2. Grocery Ahorro: Compare Prices for Our Cultural Staples

Don’t just shop the sales on cranberry sauce and stuffing mix. Be a comprador inteligente for the ingredients that make a Latino Thanksgiving special.

- Check the Regional Markets: Latino ingredients (like specific types of rice, ajíes, or plantains) may be cheaper and higher quality at a local ethnic market than at a large chain supermarket. Do a quick price comparison check between the two.

- Bulk Buying Basics: Ingredients like large bags of rice, dried beans, or large bottles of oil are often far cheaper when bought in bulk. If your familia is huge, consider splitting the cost of a massive bag of rice with a cousin.

- Know Your Regional Prices: Grocery prices vary widely across the U.S. In recent years, the cost of a full dinner has been lowest in the South and highest in the West (Farm Flavor). If you live in an expensive metropolitan area, cutting costs is even more vital.

3. Embrace the Potluck Power-Up: The Reunión Spirit

In our culture, showing up with food is an act of love and respect. Use this tradition to your financial advantage. The potluck model is an excellent tool for budget management.

- Assign Categories, Not Dishes: Instead of asking Tía to bring her famous flan, ask her to bring “the dessert.” Ask your brother to handle “all drinks and ice.” Assigning categories prevents doubling up and distributes the highest costs evenly across the family.

- The Appetizer Ayuda: Appetizers are easy, low-cost contributions. If your guest list is large, ask guests to simply bring an appetizer. This keeps the main cooking costs with the host while still embracing the spirit of sharing.

4. Decode the Black Friday Trap: Don’t Trade Food Savings for Debt

Thanksgiving is a feast, but it’s also the gateway to Black Friday and the Christmas shopping spree. The greatest financial danger isn’t the cost of the pavo, it’s the credit card debt you take on immediately afterward.

- Control the Card: Remember that nearly one-quarter of Hispanic Americans intend to take on holiday debt this year, compared to 11% of their non-Hispanic counterparts (CivicScience). If you save $50 on your Thanksgiving meal, put that $50 directly into a “Holiday Gift Savings” account, or use it to pay down existing debt, instead of immediately spending it on a Black Friday deal.

- Keep Your Eyes on the Prize: Your financial goal isn’t just surviving Thanksgiving. It’s building a foundation for long-term prosperity. Every dollar you save on dinner is a dollar that can go towards reducing that looming holiday debt.

5. Simple Decoración: Focus on Family, Not Frivolity

Avoid the expensive holiday centerpieces and mass-produced decorations. Our greatest decorations are our family and our culture.

- DIY Decorations: Use natural elements like pumpkins, colorful gourds, and candles. You can create a beautiful, rich centerpiece using seasonal produce from your own grocery haul.

- Family Photos: Instead of buying new holiday trinkets, use framed family photos from past gatherings as your decoration. It emphasizes the conexión and history you’re celebrating, not the consumerism.

And that’s it, hermanos.

This Thanksgiving, celebrate the abundance you’ve achieved and the prosperous future we are building together. Smart spending today is the greatest gift of hope you can give your familia tomorrow.

Got a complicated question about debt payoff or how to save for that big family trip?Remember you always have a dedicated resource: Ask Gabi, the “judgment free zone” for all of your financial questions! You can Ask Gabi anything, anytime right in the app.