Welcome, familia!

For many of us, higher education is the key to opportunity. But with opportunity often comes the weight of student loan debt. If you’re a young professional just getting started, that debt can feel like a heavy anchor. This burden disproportionately affects our community: two out of five (40%) of Hispanic or Latino student loan borrowers have experienced default in the last two decades, a sign of the steep repayment challenges many of us face (The Student Loan Default Divide: Racial Inequities Play a Role).

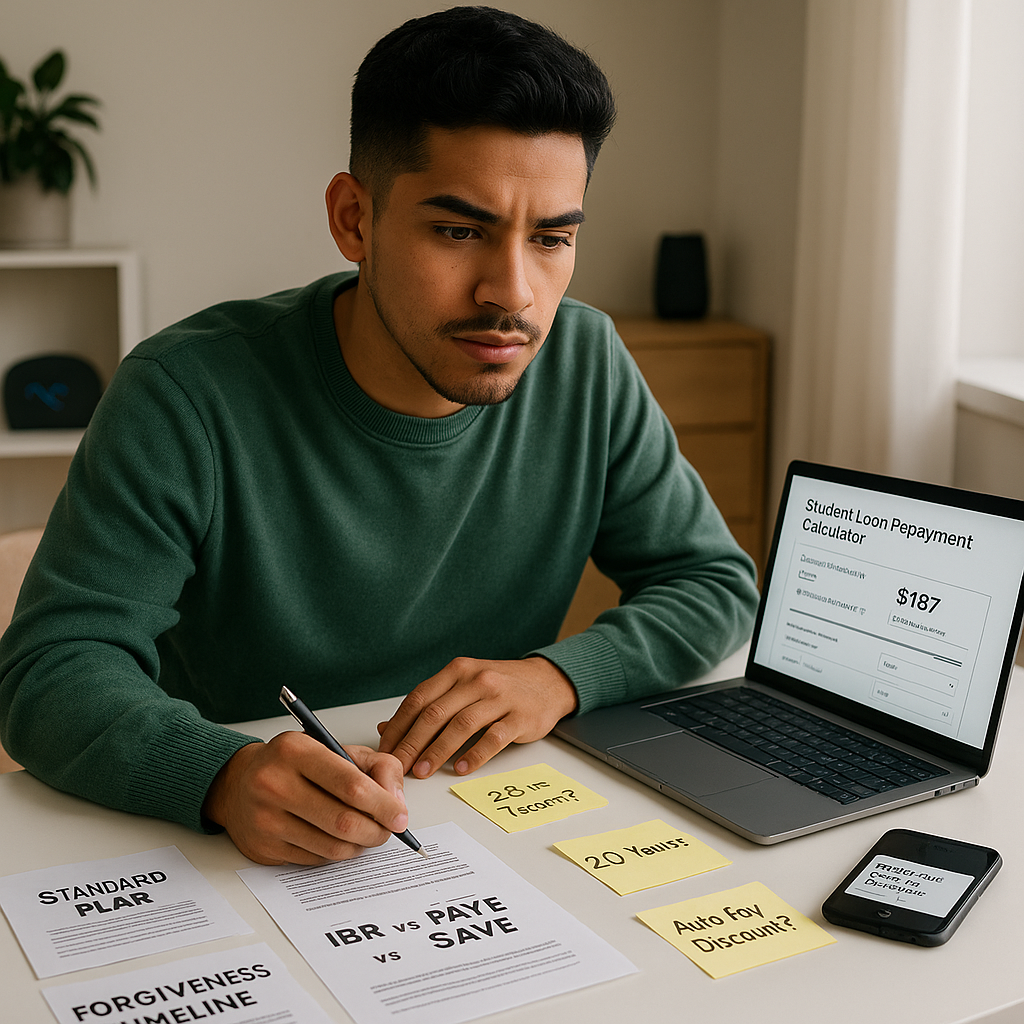

This is our reality, but it doesn’t have to control our financial destiny. Choosing the right repayment strategy is a powerful way to manage your cash flow now while planning for a secure future. We need a strategy that understands the unique financial situations many of us face, like sometimes supporting an extended family or navigating fluctuating early-career incomes.

The most flexible solution offered by the U.S. Department of Education is an Income-Driven Repayment (IDR) Plan. IDR plans adjust your monthly payment based on how much you earn and your family size, ensuring your loan payments don’t crush your budget.

Understanding Your Federal Student Loan Options

Before diving into the IDR details, it’s important to know the foundation.

| Repayment Plan | Key Feature | Who It’s Best For |

| Standard Repayment | Fixed payments over 10 years. You pay less interest overall. | Borrowers with a stable, higher income who want to pay off debt quickly. |

| Income-Driven Repayment (IDR) | Monthly payments are adjusted annually based on your income and family size. Can lead to loan forgiveness. | Borrowers who need lower, more flexible payments, especially those in early career or public service. |

The Four Main IDR Plans: Finding Your Fit

IDR plans are not one-size-fits-all. Each has specific rules about how your “discretionary income” is calculated, how long it takes to qualify for forgiveness, and what types of federal loans qualify.

- Saving on a Valuable Education (SAVE) Plan (The Newest Option):

- The Payment: Calculates your payment using 10% of your discretionary income for undergraduate loans, and 5% for graduate loans (or a weighted average if you have both).

- The Forgiveness: After 10 years of payments for original loan balances of $12,000 or less. Forgiveness timeline increases for higher balances, maxing out at 20 or 25 years.

- Key Advantage: Any interest that your payment doesn’t cover will not be added to your principal loan balance. This is a game-changer that prevents your balance from growing!

- Income-Based Repayment (IBR):

- The Payment: 10% or 15% of your discretionary income (depending on when you took out the loan).

- The Forgiveness: After 20 or 25 years of qualifying payments.

- Pay As You Earn (PAYE):

- The Payment: 10% of your discretionary income. Payments are capped, meaning they will never be higher than what you would pay under the Standard 10-year plan.

- The Forgiveness: After 20 years of qualifying payments.

- Income-Contingent Repayment (ICR):

- The Payment: The lesser of 20% of your discretionary income OR the amount you would pay on a fixed 12-year plan.

- The Forgiveness: After 25 years of qualifying payments.

Smart Strategies to Take Control of Your Loans

Choosing an IDR plan is the first step; managing it smartly is the second. We, as a community, are known for our resourcefulness, and these steps reflect that:

- Recertify Your Income Every Year (On Time!): Your IDR payment is based on your most recent tax return or other income documentation. You must reapply annually, even if your income hasn’t changed. Missing the deadline means your payment might jump back to the higher Standard Plan amount, creating financial stress we want to avoid.

- Use the Official Loan Simulator Tool: The U.S. Department of Education offers an online Loan Simulator that allows you to input your loan types, income, and family size to see exactly what your monthly payments would be under each IDR plan. This tool is your best friend for making an informed choice.

- Simplify Payments with Autopay: Enroll in automatic payments through your loan servicer. Not only does this guarantee you never miss a due date (avoiding penalties and credit hits), but many servicers offer a small interest rate reduction for signing up. Every dollar saved on interest is a dollar back in our pockets.

- Know the Rules for Deferment and Forbearance: If a sudden job loss or medical crisis hits, federal loan programs offer temporary financial relief options like deferment or forbearance.

- Be Aware: While these pause your monthly payments, interest may continue to accumulate, adding to your total debt. Use them only when absolutely necessary, and only after exploring if a $0 IDR payment might be an option first.

We have the ambition and the work ethic to build a powerful economic future. By mastering your student loan repayment, you are laying a stronger foundation for yourself, your familia, and our entire community.

👉 Ask Gabi anything, anytime.

Stay tuned! We got you!