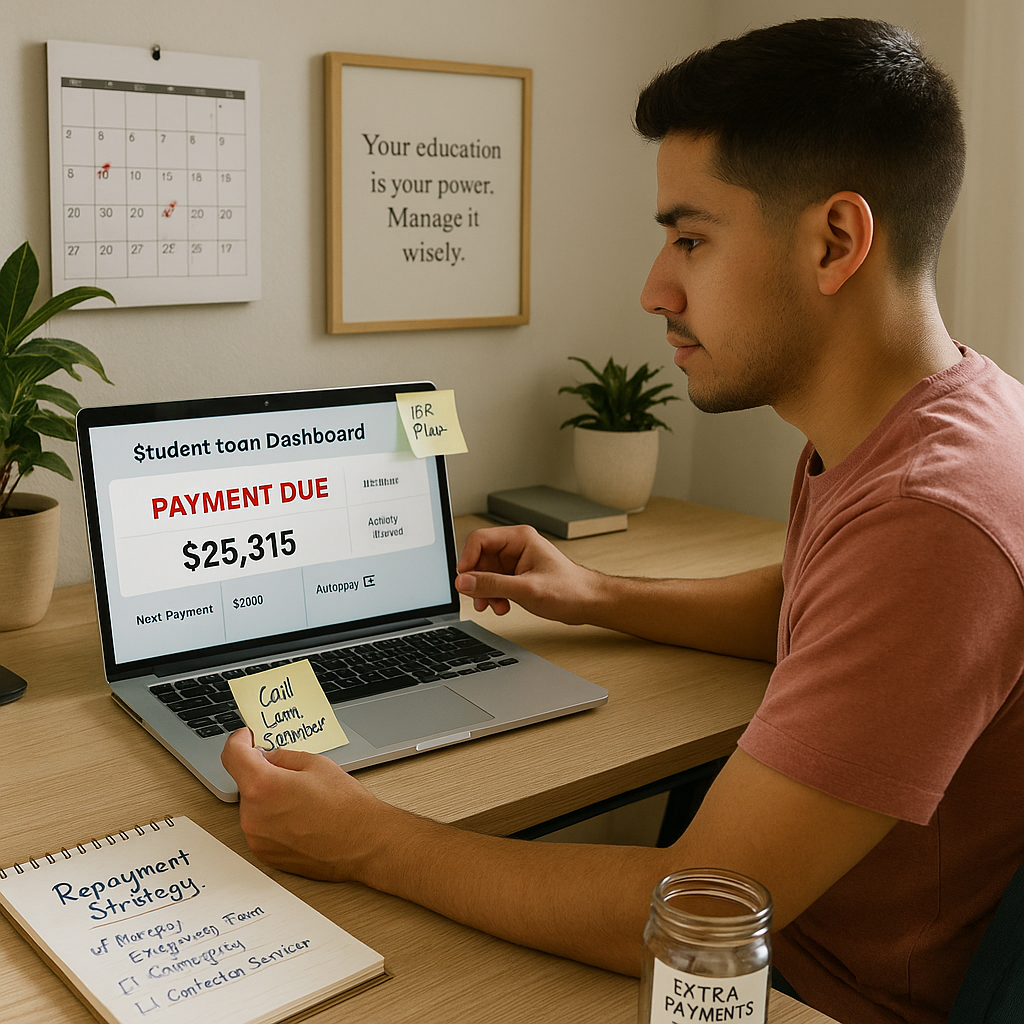

For us, the pursuit of higher education in the U.S. is often a family sacrifice, a move to secure a better future not just for ourselves, but for our whole community. But as young Latino professionals, we know that heavy student loan debt can quickly turn that opportunity into a major stressor.

The data confirms this challenge for nuestra community: While Latino students tend to borrow less money on average than their peers, they often experience higher rates of financial stress and default. For example, over a 20-year period, about one-third of Latino borrowers may default on their student loans (The Heller School).

That’s why this conversation is so important. We need to be proactive and strategic to manage our debt and protect our financial foundation. Default is not just an administrative problem; it severely damages your credit, opens you up to wage garnishment, and hinders your ability to buy a home or secure future loans.

Here is nuestra guide to avoiding default and staying on top of your student loans.

1. Reassess Your Repayment Strategy: Focus on Federal Protections

Before exploring private options, you must leverage the federal protections designed to help borrowers in the U.S. financial system. For many young professionals, especially those early in their careers, your income may not yet fully reflect your potential, making these plans critical.

Know Your Income-Driven Repayment (IDR) Options

IDR plans adjust your monthly payment based on your income and family size. This can be a lifesaver if your starting salary is lower than expected.

- The Power of IDR: Unlike a standard plan, an IDR plan ensures your payment is manageable, even if you are struggling.

- The Default Risk Connection: Research shows that Latino students are more likely to attend for-profit schools (13% of Hispanic adults who pursued postsecondary education compared to 5% of white adults), and these schools often lead to less economic security post-graduation (Federal Reserve Board). IDR plans provide a necessary safety net for these situations.

Why Refinancing is a Big Decision

Refinancing a federal loan into a private loan can offer a lower interest rate, but it is a major trade-off.

- You Give Up Federal Protections: When you refinance with a private lender, you permanently lose access to all federal benefits, including IDR plans, federal deferment/forbearance options, and any potential loan forgiveness programs (like Public Service Loan Forgiveness).

- Best Time to Consider: Refinancing is generally only an option for those with stable income and strong credit who are absolutely certain they will never need the flexibility of federal programs.

2. Use Temporary Relief Options Strategically

Life happens. For our community, which often supports extended family, unexpected financial needs can arise. Federal deferment and forbearance options are there for these times, but they work differently.

- Deferment: Allows you to temporarily stop or reduce your payments. Interest does not accrue on subsidized loans during this period.

- Forbearance: Also allows a temporary stop or reduction, but interest always accrues on all types of loans, subsidized or unsubsidized. This means your total balance will increase.

- The Rule: Use these options only when necessary (e.g., job loss, economic hardship). Forbearance, especially, should be a last resort, as it can significantly increase your total debt over time.

3. Communication is Your Most Powerful Tool

The moment you anticipate missing a payment, contact your loan servicer. They are the gatekeepers to all federal repayment, deferment, and forbearance options.

- The Clock is Ticking: Your loan becomes delinquent after one day of a missed payment, and default typically occurs after 270 days. Don’t wait until the last minute.

- Ask to Change Your Plan: A direct conversation can quickly switch you into a more affordable IDR plan before your account status becomes a serious credit issue.

- Confirm Everything in Writing: After any conversation about changing your plan or pausing payments, ask the servicer to send you an email or letter confirming the details. This is your paper trail.

4. Build Your Financial Shield: Savings and Automation

Effective student loan management is rooted in stable, proactive financial habits.

A. Set Up Auto-Pay (and Get a Discount)

Enroll in automatic payments directly from your bank account.

- Never Miss a Deadline: This eliminates the risk of human error and late payments, which are reported to credit bureaus.

- The Interest Bonus: Most federal and private servicers offer a minor interest rate reduction (e.g., 0.25%) just for enrolling in auto-pay. It’s a guaranteed way to save money.

B. Prioritize Your Emergency Fund

An emergency fund is your critical defense against default. If you lose your job or have a family emergency, these savings (not a missed loan payment) should cover the gap.

- The Target: Aim to save three to six months’ worth of essential expenses.

- The Wealth Gap Context: Because of the racial wealth gap, where the typical Latino household holds significantly less net worth than the typical white household, we have less of a cushion to absorb financial shocks (Student Loan Planner). Building this emergency fund is arguably more critical for nuestra long-term financial stability.

C. Pay Extra When Possible

If you’re already on a manageable IDR plan and your finances improve, even small, extra payments can save you thousands in interest.

- Designate the Payment: When making an extra payment, explicitly instruct the servicer to apply the additional amount to the principal balance of the loan with the highest interest rate. This ensures the money directly reduces the total debt, not just prepaying your next month’s bill.

Mi gente, student loan debt is a heavy burden, but it is one we can conquer with informed action. By understanding the specific options available and setting up strong financial habits, we can convert our education into real, lasting wealth for ourselves and for the generations to come.

Stay focused on your financial goals. ¡Adelante!

👉 Ask Gabi anything, anytime.

Stay tuned! We got you!